Understanding customer psychology is crucial to drive sales and ensure business growth.

One of the influential psychological theories is that we fear losing considerably more than we desire to gain something.

It says that the psychological pain of losing something is twice the pleasure of gaining something of the same value.

This means losing $100 hurts more than gaining $100 will please us. That means we always prefer to avoid losses to acquire gains.

In loss aversion theory or prospect theory, customers would rather avoid losing something than gain something of the same value.

This aversion significantly influences economic decision-making processes, as individuals and institutions tend to make economic decisions based on the fear of loss.

The concept of “limited time offers” or “limited stock available” leverages our fear of missing a deal, prompting customers to purchase instead of losing the deal.

Let’s understand the concept with an example; imagine you have two options,

Option A: You receive $ 1000, and Option B: You have a 50% chance of winning $ 2000 and a 50% chance of winning nothing.

Which option would you choose?

Most people would choose option A as they feel losing, instead of option B which offers a higher value.

This is one of the most potent psychological phenomena marketers use to sell products and influence customers’ decisions.

Let’s explore the concept and strategies for implementing loss aversion techniques, driving more sales, and enhancing customer engagement in the competitive market.

Visitors leave your website without taking action?

They don’t trust your site or feel urgency to act. WiserNotify builds both, turning doubt into action & visitors into customers.

Why Loss Aversion Marketing Works

Loss aversion or prospect theory has a powerful impact on decision-making, leading people to make choices that are not always in their best interest.

Humans tend to be loss-averse when it comes to behavioral decision-making, which is closely linked to risk aversion.

Individuals with higher risk aversion prefer options with lower uncertainty, and this bias influences them to prioritize avoiding potential losses over making rational investment decisions.

That means the negative emotions of losing something are stronger than the positive emotions of gaining something of equivalent gain.

Loss aversion marketing leverages the FOMO concept, creating a sense of urgency that compels consumers to purchase.

Techniques such as limited-time offers, exclusive deals, or low stock influence customers’ decisions.

Further, when the products are limited, their perceived value increases, and consumers are more likely to view these products or offers as more desirable, prompting quicker purchasing decisions.

Loss aversion marketing triggers an emotional response that can drive consumers to act impulsively and avoid negative emotions associated with loss.

Psychological Factors Behind Loss Aversion and Prospect Theory

Loss aversion in behavioral economics describes individuals’ tendency to avoid losses rather than acquire equivalent gains. Here are a few psychological factors behind loss aversion –

Status Quo Bias

Status Quo Bias can be described as our preferences to maintain the current status or situation.

The discomfort associated with the change or potential loss often leads consumers to stick with familiar choices

Status quo bias is influenced by the reference point in prospect theory, where losses loom larger than gains relative to this reference point.

Status quo bias can make people resistant to change, which marketers can use to craft and highlight the risk of not acting and encourage customers to purchase to avoid disrupting their status quo.

Endowment Effect

The endowment effect is a tendency of people to value something they already own rather than something they do not.

For example, you might think the wine bottle you purchased a few years ago is probably more valuable than the bottle you bought today of the same amount.

Marketers can use the endowment effect by offering free trial periods, giving customers a sense of ownership, and increasing the likelihood of purchase.

During the free trial period, customers experience ‘only gains’ as they enjoy the benefits of the product or service without any cost, leading to potential difficulties in giving it up once the trial ends.

Cognitive Biases at Play

Cognitive psychology, such as confirmation bias and anchoring, plays a role in loss aversion. It leads people to favor information that confirms their preexisting beliefs while anchoring relies on the first information encountered.

Marketers can influence decision-making and prompt consumers to act to avoid perceived negative outcomes.

These are a few psychological factors that play a crucial role in loss aversion.

Loss Aversion Marketing Strategies

Loss aversion, a powerful cognitive bias, can help you increase conversions, drive more sales, and increase sales.

Crafting offers regarding potential losses instead of gains can create FOMO and leverage the psychological principle to boost sales.

Here are some techniques to help you harness loss aversion in your marketing efforts.

Emphasizeasize Potential Losses (What customers might miss out on)

Instead of just highlighting the benefits of your product, focus on what customers stand to lose if they don’t make a purchase.

For example, “Don’t miss out on this limited-time offer” or “Act now to buy at the lowest price” can motivate customers to take action.

This approach creates a fear of regret or losing the offer, making it more likely that potential customers will purchase to avoid regret of missing out on opportunities.

Reframe Prices & Offers (e.g., Daily cost vs. annual loss)

Reframe prices in such a way that the cost seems more manageable. For example, instead of saying the service costs $ 365 per year, say it costs “just $ 1 per day.”

That makes the audience feel the investment is low and easier to commit.

Additionally, you can show them what they will lose if they don’t purchase your product or service.

For example, “If you don’t subscribe now, you might be losing $ 100 a year in savings.”

This approach aligns with effective investment strategies by incorporating loss psychology to help customers avoid emotionally based decisions.

Leverage Negative Framework

Instead of promoting only your product’s positive aspects and benefits, consider what customers would lose if they didn’t buy your product or service.

For example, “Avoid costly repairs with our warranty plan.”

Loss aversion can sometimes lead to risk-taking behavior as a response to the psychological effects of experiencing a loss.

Use Retargeting Campaigns

Retarget customers interested in your product but have not taken further steps or completed the purchase.

Send them reminders by highlighting what they might lose by not completing the purchase. For example, “Only a few hours left to claim a discount on the products in your cart.”

These strategies can effectively leverage the psychological principles of loss aversion marketing to drive more sales and boost conversions.

Remember, the key focus is to create a sense of urgency and what they will lose if they don’t act quickly.

Build trust & FOMO

Highlight real-time activities like reviews, sales & sign-ups.

Understanding Loss Aversion in Behavioral Economics

Nobody likes to lose, especially when it could result in losing money. For example, customers might agree to pay smaller costs instead of potentially greater ones.

This decision is due to loss aversion, which encourages individuals to avoid financial risks.

Loss aversion prevents people from making the best decisions to avoid failure or risk, but it’s essential to avoid loss aversion when making decisions with potential gains.

Let’s grab some examples to understand loss aversion.

Loss Aversion in Action: Real-World Examples

Here are a few examples of using loss aversion in your marketing and boosting your conversion rates.

Free Trials

People work hard to own something. And once they have, they hate to let it go.

This is true whether the thing is ours or if we are using others and think of it as ours. We offer higher value to the things we own than we don’t.

Once the customers sign up for the free trial, they will feel they have nothing to lose by trying your product, which can lead to high conversion rates.

Once the user gets used to the full version of your product, it’s difficult for them to let it go.

Loss aversion makes them sign up for a fully paid version of your platform rather than lose out on the features they’ve already enjoyed for the last 7 or 30 days.

Here’s an example of a Free Trial from SEOptimer.

Limited-Time Offers & Scarcity

Limited-time offers create a sense of urgency, encouraging customers to act quickly so they don’t miss the opportunity.

Customers are more likely to purchase When they have limited time to grab the offer.

The strategy works especially well for online sales, where customers see time ticking away a few hours before the offer expires.

As a result, customers are likelier to purchase, emphasizing the limited timeframe instead of losing a significant discount.

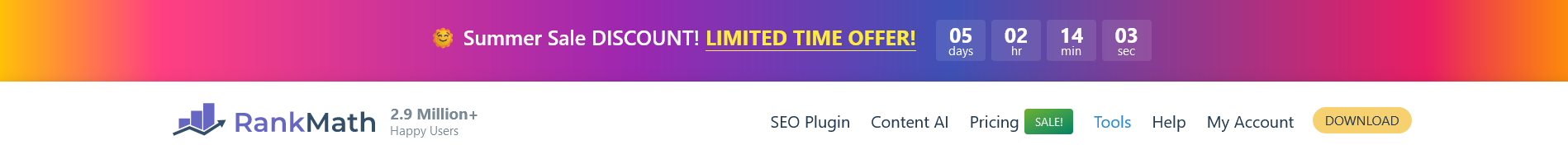

For example, RankMath runs a sale offering discounts for customers.

It creates a sense of urgency and encourages customers to purchase before the sale ends, and FOMO influences their decision to act fast, boosting sales.

Framing Discounts as Avoiding Losses

Choosing words carefully matters. For example, instead of saying, “Avail 20% off,” you can choose” Save $200 when you make a purchase.”

Instead of simply offering discounts, framing them in terms of losses avoided can be more effective.

It’s more effective, right?

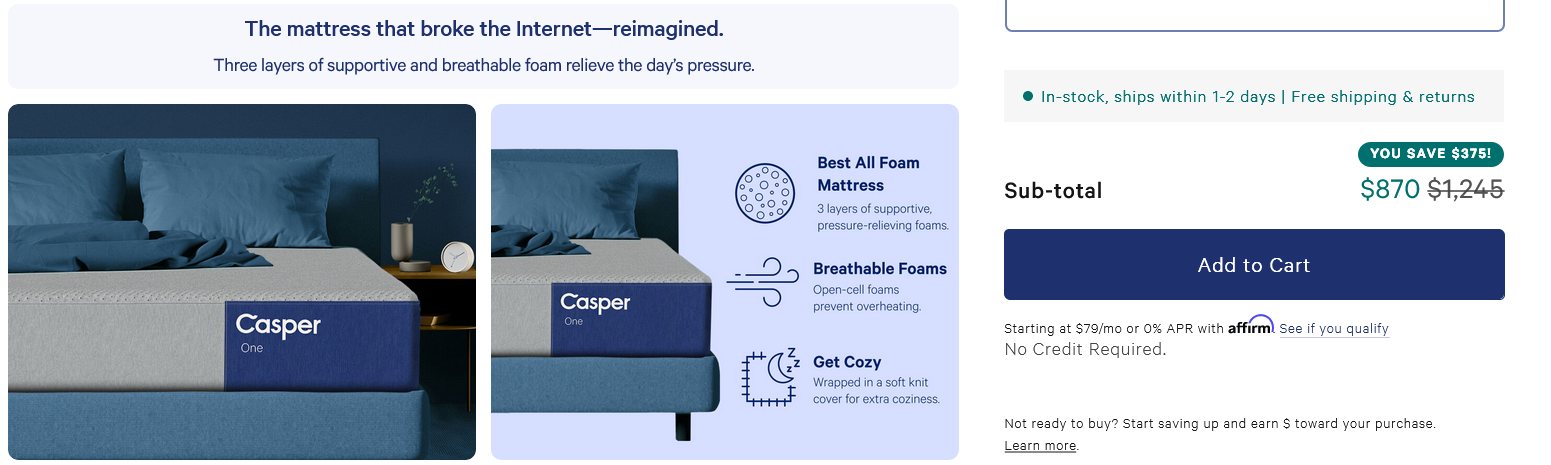

The way value is presented can influence the customer’s decision. For example, Casper frames discount offers showing customers how they can save money and influence them to act faster.

Early-Bird Special

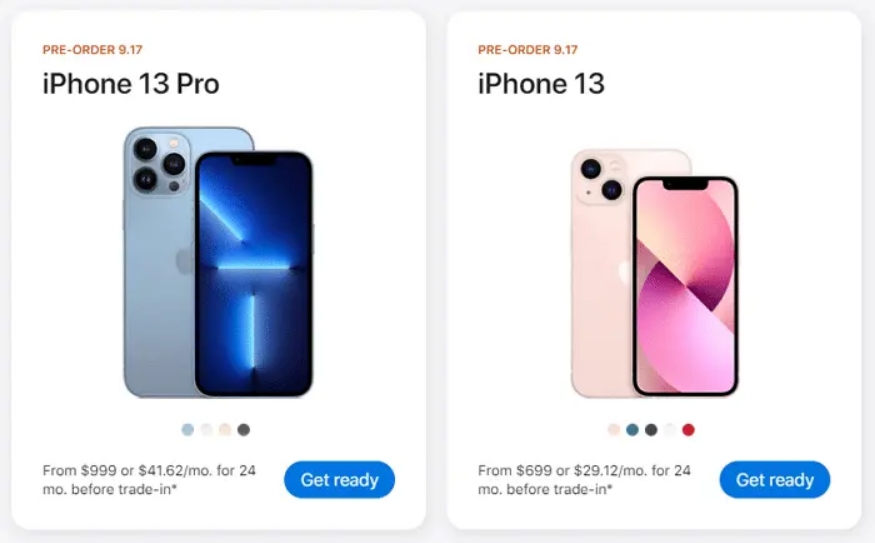

Pre-order deals play upon loss aversion by offering them early access and bonuses to new items.

Early-bird specials reward customers for taking action early but also make customers feel like they might miss out on opportunities if they avail themselves of them late.

This strategy is commonly used for event ticket sales, conferences, and courses to influence customers and create an ownership they want to preserve.

For example, Apple’s Pre-Order packs offer pre-orders at a set price, influencing customers to quickly pre-order before the offer expires.

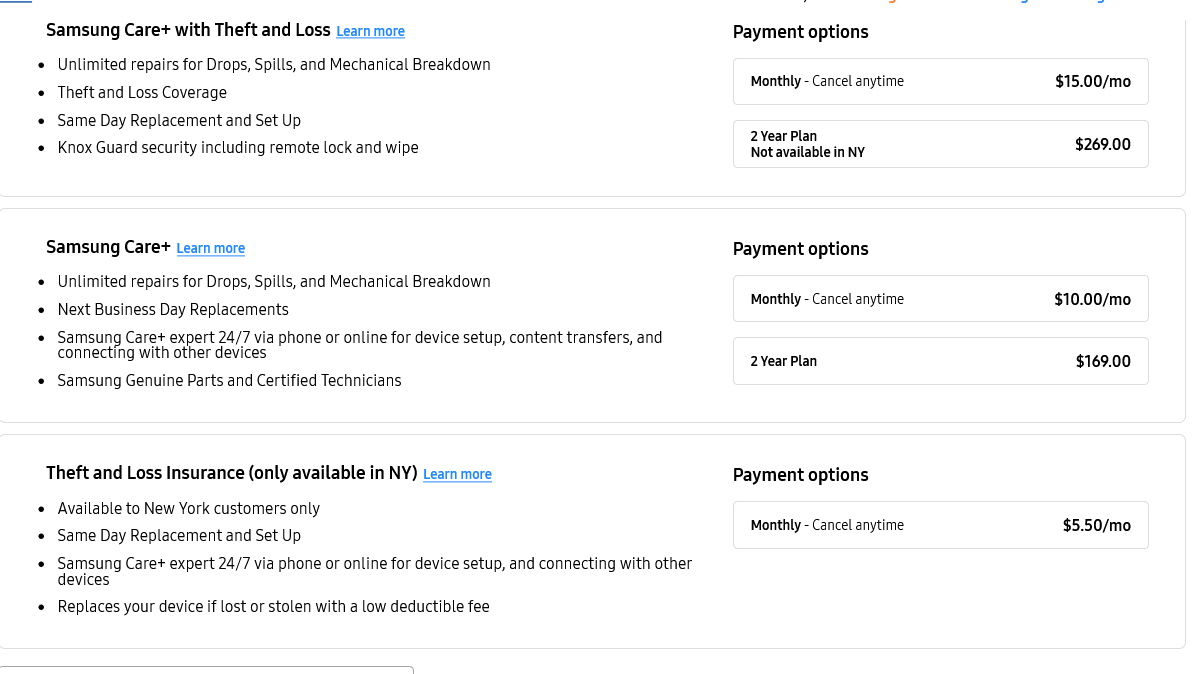

Framing Upgrades and Add-ons

Businesses often frame upgrades and add-ons as essential, making customers feel that not opting for these extras would result in a loss of value or a suboptimal experience.

This strategy helps brands to increase their sales and influence customers to make that essential purchase.

For example, Samsung offers Samsung Care+, a premium protection plan to its customers that covers various protection plans and extended warranty.

Money Back Guarantee

If you can’t offer a free trial, you can offer them a money-back guarantee.

Customers might hesitate to purchase, but a money-back guarantee can effectively alleviate customers’ fears and encourage them to buy.

A money-back guarantee signals confidence in your products or service quality and ultimately drives more conversions.

NordVPN offers a 30-day money-back guarantee if customers feel dissatisfied.

These real-world examples illustrate how loss aversion can influence customer behavior and decisions.

By making potential losses more noticeable, businesses can drive more sales and quicker actions from their customers.

Tips for Crafting Loss Aversion Ads

Crafting effective loss-aversion marketing ads requires a strategic approach that taps into customers’ fear of missing out and their desire to avoid losses.

Here are some detailed tips to help you create compelling loss-aversion ads:

H3: Focus on the Pain Point the Customer Wants to AvoidUtilizeilize Powerful Visuals (Contrasting images of before/after)

Identify the specific problems your product can solve and highlight how your product can help avoid this issue.

Your ads should clarify what discomfort, inconvenience, or financial risks the customers face if they don’t choose your product.

For example, you can say, “Don’t let slow internet ruin your online meetings. Switch to our high-speed plan to enjoy seamless connectivity.”

Compelling Copywriting that Evokes the Fear of Loss

Make sure your copy uses action-oriented language that encourages them to take action to avoid negative outcomes.

Your copy should evoke a sense of urgency and FOMO, creating a perception of high value and demand. Make your audience feel like they have to act faster, or they will lose the chance to get something special or rare.

For example, there are only 10 products left—don’t miss out on the exclusive product that triggers loss aversion and encourages action.

Use Testimonials and Social Proof

Testimonials are positive reviews from satisfied clients, while social proof shows the credibility of your product, offer, or solution.

Both of these can help the audience see the results and benefits of using your product or service and also create a fear of missing out on something that others are enjoying.

For example, you can share quotes, ratings, reviews, case studies, or statistics that show how your product has helped others.

Personalize Your Message

Make sure your ads address the specific needs and fears of different customer segments.

Personalize your message to ensure it resonates more deeply with your audience and makes the potential loss seem more relevant.

For example, As a valued customer, we are offering you access to our exclusive benefits.

Use a Strong Call to Action (CTA)

A strong CTA should provide clear and specific instructions to your audience on what they can do next and the risks of what they might lose of not take action.

For example, Get instant access to a limited offer that creates a sense of urgency and loss aversion and compels your audience to act on your offer.

Wrap up

In behavioral economics, loss aversion refers to the phenomenon where individuals perceive a real or potential loss as emotionally more severe than an equivalent gain.

Loss aversion is a powerful tool that can help to drive more sales and increase conversions.

Focusing on what customers might miss if they don’t act faster rather than what they might gain can encourage them to make quicker decisions.

Using tactics like emphasizing potential losses, reframing prices, utilizing social proof, and creating scarcity with time-sensitive deals effectively harness the psychological power of loss aversion.

Further, crafting ads that highlight the pain points of the audience using compelling visuals, CTAs, and social proof can make your loss aversion campaigns more effective.

By understanding and applying strategies of loss aversion, you can create a powerful marketing campaign to drive more actions, sales, and business revenue.