Acquiring new customers can be much more expensive than selling to existing customers. You have a 5 to 20 percent chance of selling to a new customer. You have a better chance of selling to an existing customer, with a success rate of 60 to 70 percent.

Despite this, many businesses focus on the costs of gaining new customers. It’s important to understand these costs for sustainable growth, ensuring your expenses don’t exceed your revenue.

According to a 2023 study, companies that effectively manage their CAC tend to grow 20% faster than those that don’t.

Customer acquisition cost is a key measure that shows how much a business spends to attract new customers. It helps businesses evaluate the return on investment to grow their customer base.

Tracking CAC helps businesses refine their strategies and optimize their sales and marketing expenses.

This guide simplifies the CAC calculation, uncovers hidden costs that could impact your bottom line, and demonstrates how this key metric can supercharge your marketing and sales strategies.

Start Free Trial

Highlight real-time activities like reviews, sales & sign-ups.

How to Calculate Customer Acquisition Costs Effectively?

Customer acquisition costs (CAC) vary by industry due to factors like sales cycle length, purchase value, and average customer lifespan.

CAC includes several types of costs, such as:

1. Ad Spend

Amount spent on ads to attract new customers or retarget existing ones. Track effectiveness by comparing revenue earned from ads to the amount spent.

2. Employee Salaries

Costs related to staff who drive marketing goals and manage customer relationships. Use automation and digital tools to optimize these costs.

3. Creative Costs

Expenses for creating content, including hiring talent or team meeting costs. All related activities fall under this category.

4. Technical Costs

Money spent on tools and technology for marketing and sales, like CRM systems or pipeline management software.

5. Publishing Costs

Costs associated with releasing marketing campaigns, such as TV spots or online ads.

6. Production Costs

Expenses for physically creating content, like video production, including equipment and editing.

7. Inventory Upkeep Costs

Costs for maintaining products, whether selling physical products or digital (software updates).

To Calculate CAC Manually

- Choose a time period (monthly, quarterly, yearly)

- Sum your sales and marketing expenses

- Divide sales and marketing expenses by the number of new customers gained during that period

Compare your CAC with other business metrics for marketing efficiency and customer retention insights. Understanding CAC helps you optimize your marketing and sales efforts, improve customer lifetime value, and manage company spending effectively.

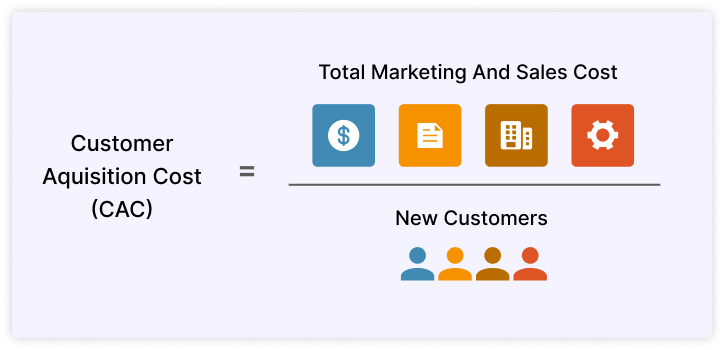

The formula for Calculating Customer Acquisition Cost

To calculate the customer acquisition cost formula.

CAC = Total Cost / Number of New Customers Acquired

Here are some Customer acquisition cost examples for different industries.

1. Retail Industry

A clothing store spends $10,000 on marketing and sales over a month and acquires 200 new customers.

CAC = Total Marketing and Sales Cost / Number of New Customers

$10,000 / 200 = $50

It costs the store $50 to acquire each new customer.

2. Software as a Service (SaaS)

A SaaS company invests $50,000 in marketing campaign and sale’s team in a quarter and gains 1,000 new subscribers.

CAC = Total Marketing and Sales Cost / Number of New Subscribers

$50,000 / 1,000 = 50

Each new subscriber costs the company $50 to acquire.

3. E-commerce

An online store spends $20,000 on digital ads and promotions and acquires 500 new customer in a month.

Total Advertising Costs / Number of New Customers

$20,000 / 500 = $40

The store spends $40 to get each new customer.

What is a Good Customer Acquisition Cost – CAC Benchmark

Customer acquisition cost (CAC) varies a lot between industries, so looking at CAC alone isn’t very helpful because the average can differ widely.

To see if your CAC is good, compare it to the customer’s lifetime value (LTV). You spend CAC to get a new customer, while LTV is how much that customer is worth over time.

A good rule of thumb is to keep your CAC much lower than your LTV. Ideally, your CAC should be about one-third or one-fourth of your LTV. Aim for an LTV to CAC ratio of 3:1 or 4:1.

It means you’re making more money from each customer than it costs to acquire them, which helps build profitable relationships.

Average Customer Acquisition Cost by Industries

SaaS Business

CAC can range from $200 to $2,000. SaaS companies often have higher CAC due to longer sales cycles and the need for personalized customer engagement.

E-commerce Business

CAC can range from $20 to $200, averaging around $45-$65. This variation depends on the niche, product type, and marketing strategy.

Retail Business

The CAC is generally lower for retail businesses, ranging from $10 to $100, depending on the product’s price point and sales channels.

Financial Services

Due to strict regulations and intense competition, the CAC can be quite high, ranging from $175 to over $1,000.

Healthcare Industry

CAC in the healthcare industry can range from $200 to $500, reflecting the specialized nature of services and the regulatory environment.

Start Free Trial

Highlight real-time activities like reviews, sales & sign-ups.

Some Relevant Stats of Good CAC

1. Average CAC Across Industries

The average CAC across all industries is about $205. This number highlights the need for businesses to compare their CAC to industry norms to determine efficiency.

2. Rising CAC Costs

CAC has grown by over 50% in the last five years due to increased competition and higher digital marketing costs.

3. CAC Ratio and Customer Lifetime Value (CLTV)

Successful companies aim for a CAC ratio where the CLTV is at least three times the CAC. This 3:1 ratio ensures profitability and a healthy return on investment.

4. CAC by Marketing Channels

Paid advertising typically has the highest CAC, while organic methods like social media and referrals have the lowest. For example, organic social media can have a CAC up to 70% lower than paid search ads.

5. Impact of Strategy on CAC

Companies that invest in content marketing and SEO often have a 41% lower CAC than those relying solely on paid advertising, as these strategies attract customers more cost-effectively.

6. Industry Specific CAC

In the tech sector, SaaS businesses report an average CAC of $395, while non-SaaS tech firms have a slightly lower average of $313. It reflects differences in customer acquisition strategy and product complexity.

How to Analyze Customer Acquisition Cost

Understanding your Customer Acquisition Cost (CAC) helps you see how much you’re spending to bring in new customers and how to improve that spending.

Analyze Your Customer Acquisition Cost:

Initial CAC

- The cost of acquiring a new customer for the first time.

- Calculate the total marketing expenses divided by the number of new customers acquired.

Renewal CAC

- The cost of retaining an existing customer through renewal or repurchase.

- Measure the costs of customer retention efforts divided by the number of renewals.

Reactivation CAC

- The cost associated with re-engaging a previous customer.

- Track the marketing spend used to re-engage potential customers divided by the number of reactivated customers.

Market CAC

- The cost of acquiring customers specific to a particular market segment.

- Calculate the market-specific marketing and sales expenses divided by the number of customers acquired in that segment.

Customer CAC

- The overall cost of acquiring a customer, including all relevant marketing and sales expenses.

- Add up all customer acquisition costs and divide by the total number of new customers.

Product CAC

- The cost to acquire customers for a specific product or service.

- Determine the marketing and sales expense for a specific product divided by the number of customers acquired for that product.

End Users CAC

- The cost of acquiring end users of a product or service.

- Calculate the total sales and marketing expenses aimed at end users divided by the number of end users acquired.

How to Manage Your Customer Acquisition Cost

➥ Enhance Your Marketing and Sales Funnel

- Optimizing your funnel helps reduce unnecessary costs and improve efficiency in acquiring customers.

- Analyze each stage of the funnel to identify bottlenecks and improve conversion rates.

➥ Refine Your Pricing Strategy

- A well-structured pricing strategy can make customer acquisition more cost-effective.

- Test different pricing models to find one that maximizes revenue while keeping CAC in check.

➥ Maximize the Impact of Sales and Marketing Investments

- Better management of your marketing spending can lead to more efficient customer acquisition.

- Regularly review your sales and marketing expenses to ensure they yield a positive return on investment.

➥ Rapidly Connect with New Customers and Leads

- Prompt engagement can lead to higher conversion rates and lower CAC.

- Implement quick follow-ups and personalized communication strategies to capture and retain customer interest.

Conclusion

Calculating CAC is essential for understanding how much you spend acquiring new customers. Regularly tracking your CAC lets you see if your efforts are cost-effective and make adjustments if needed.

Keeping CAC manageable increases the likelihood of maintaining a healthy profit margin and sustainable growth. Regularly viewing these metrics can also guide adjustments to your acquisition strategies, ensuring you get the most value for your investment.