eCommerce is a rapidly growing industry. With over 85% of consumers shopping online, it contributes significantly to a country’s growth and GDP.

However, with eCommerce development, eCommerce fraud is also on the rise.

eCommerce fraud generally occurs through online customer transactions.

Fraudsters deceive consumers of a particular product or service by calling, visiting a website, or acting as customer support specialist.

This blog will look at the trends and statistics about eCommerce fraud in various countries and the most common types.

Build trust & FOMO

Highlight real-time activities like reviews, sales & sign-ups.

Top E-Commerce Fraud Statistics

Between 2023 and 2027, people might lose $343 billion because of online payment fraud.

Every year, the eCommerce industry loses $48 billion due to online payment fraud.

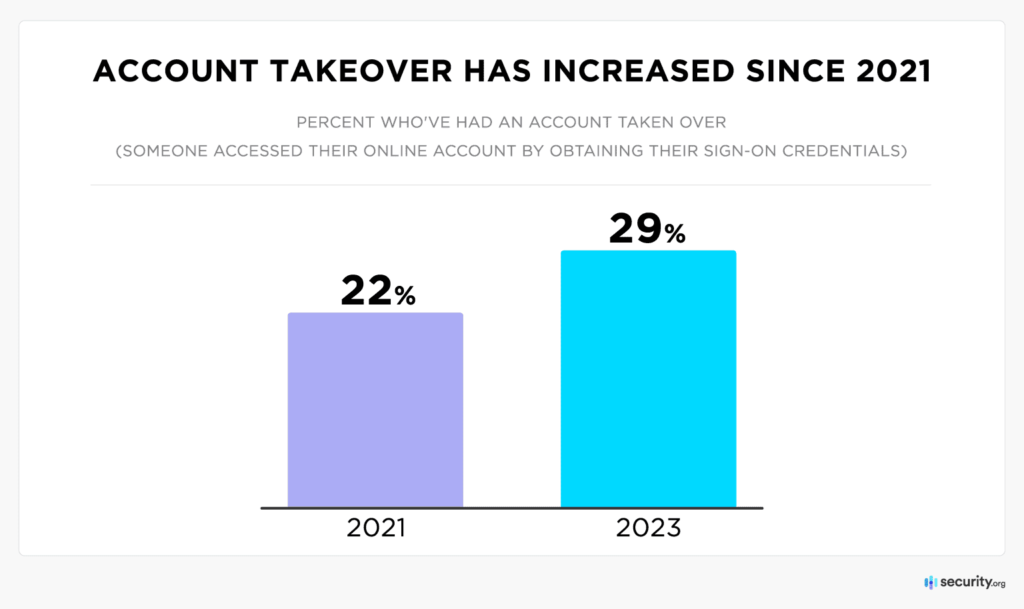

Account takeover (ATO) fraud increased by 7% in 2023 compared to 2021, making it 29% of all fraud.

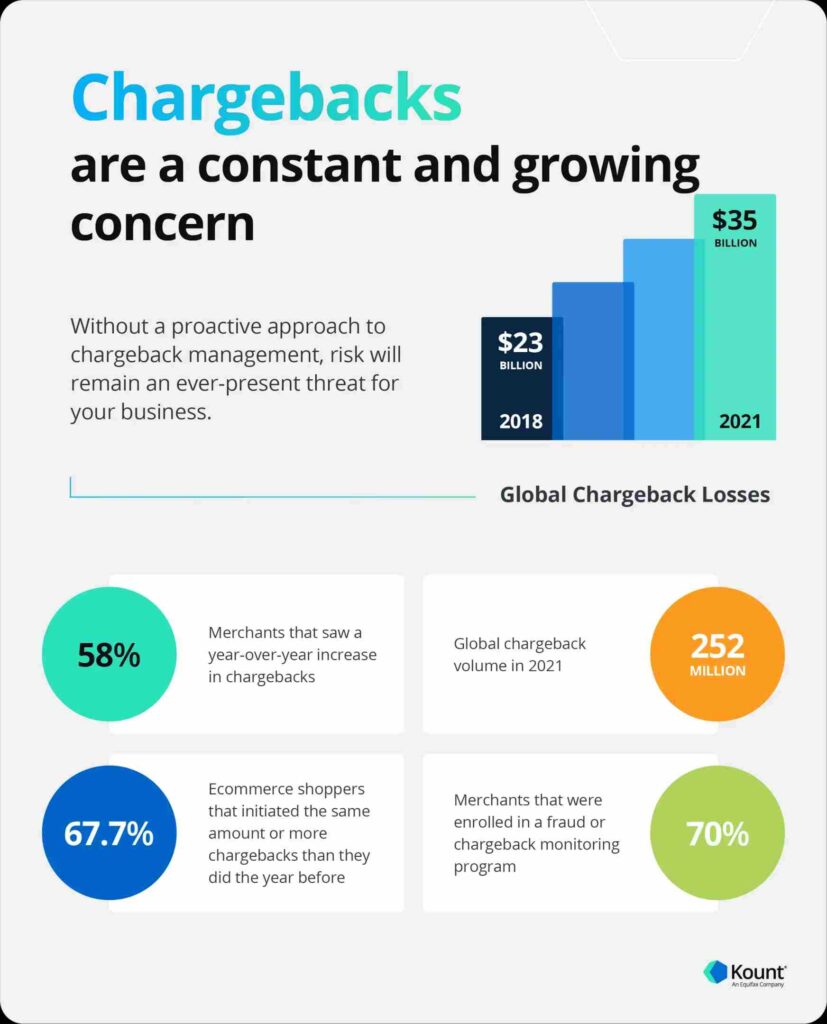

Chargeback fraud was the second most common type of fraud in 2024, affecting 34% of online shopping worldwide.

It’s predicted that by 2025, almost $200 billion will be lost to online payment fraud.

More than 43% of people have experienced online fraud.

General E-Commerce Fraud Statistics

eCommerce fraud is carried out in different ways. Many types of online fraud occur daily.

Some use customer data to commit fraud, while others steal personal and payment data.

The rise of AI and machine learning only deepens this web, as there is a rise in sophisticated AI deep fakes used in identity theft.

1. According to Exploding Topics, the eCommerce industry loses $48 billion annually to online payment fraud.

2. Over 43% of consumers have been victims of online fraud.

If we consider the global population, that means almost 2.2 billion people have been victims of online fraud.

3. WorldMetrics reports that approximately 40% of attempts at eCommerce fraud were successful.

4. Merchants bear 60% of payment fraud losses that occur. That calculates to around $18 billion in losses.

5. According to CNBC, Amazon has faced over $700,000 in financial losses due to refund fraud.

6. According to Security.org, ATO fraud rose to 29% in 2023 compared to 2021. An increase of 7%.

An account takeover fraud is when a fraudster takes over an account and poses as the person whose account was hacked.

These kinds of frauds result in compromised login credentials, personal and payment data breaches, etc.

These most likely happen on eCommerce websites and social media platforms. This is the current trend in ATO fraud.

7. Of the 29%, 21% were business accounts, 75% were personal and 4% functioned as both.

8. According to IBM, the average corporate breach costs nearly 5 million dollars.

9. Finanso states that identity theft is the second most common fraud in the European Union after monetary fraud. One in five Europeans suffered from identity theft between 2020 and 2022

10. Chargeback fraud was the second most common in 2022 affecting 34% of the global eCommerce industry.

Friendly fraud or chargeback fraud occurs when the consumer disputes an online payment, credit card, or debit card used for a purchase.

The customers themselves initiate payments and then claim that the charge was fraudulent or unauthorized. The current trend in friendly fraud is as follows.

11. According to a Ravelin survey of over 6,000 consumers in Europe, more than 40% of eCommerce consumers admit to committing friendly fraud.

12. The global losses to friendly fraud in 2021 were $35 billion.

13. According to BusinessWire, retailers reported a 19% increase in friendly fraud in 2023.

14. According to Visa, Friendly Frauds can account for almost 75% of all chargebacks claimed by consumers.

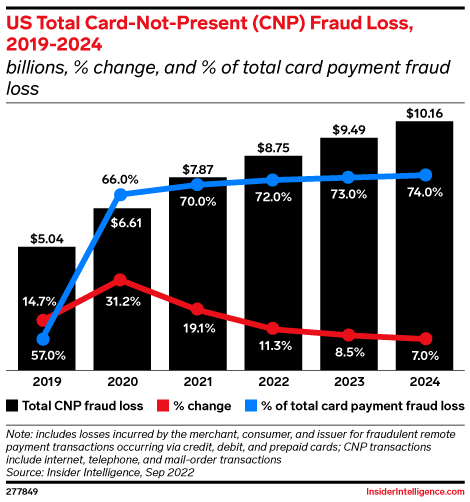

15. According to a UK Finance report in 2021, Card-not-present fraud constituted up to 85% of all card fraud in 2020.

Card-not-present fraud occurs when a hacker obtains a cardholder’s name, expiration date, account number, billing address, and three-digit CVV security code and attempts to conduct fraudulent transactions.

These are details that can be obtained electronically without needing physical evidence. The current Card-Not-Present Fraud statistics are listed below.

16. The US eCommerce industry is estimated to lose $10.16 billion to card-not-present fraud this year.

17. CNP accounts for the highest share of unauthorized transactions in the UK at 395.7 million Pounds.

Must Read: 100+ ECommerce Statistics & Trends

Build trust & FOMO

Highlight real-time activities like reviews, sales & sign-ups.

Common E-Commerce Scam Tactics

The tactics to commit eCommerce fraud are evolving every day. Cybercriminals use some of the tactics listed below to scam individuals and merchants to commit fraudulent activities.

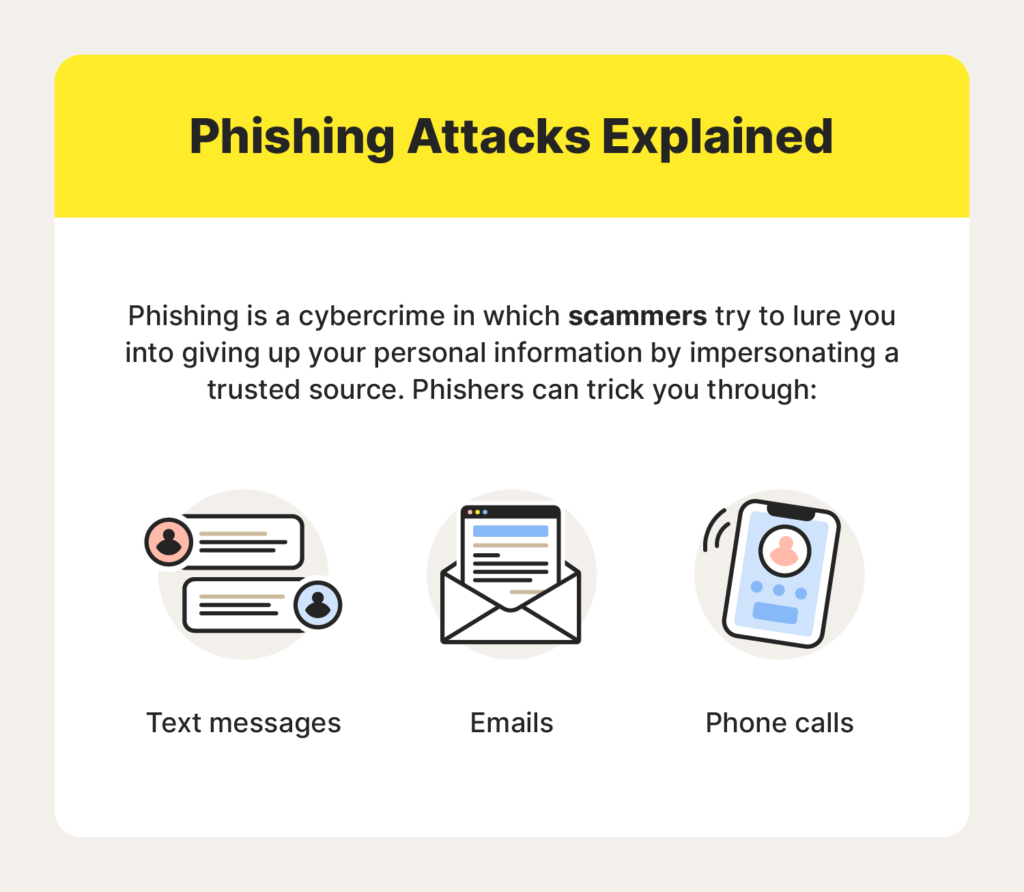

Phishing Attacks

Phishing involves using calls, emails, text messages, or websites to trick people into sharing sensitive information, which is then used to commit fraudulent transactions.

In a phishing attack, the cyber criminal pretends to be someone the victim trusts (usually a representative of a well-known brand) and then convinces the victim to take action, usually by clicking a link.

This then installs ransomware that tracks the victim’s data without their knowledge and steals sensitive information.

According to GreatHorn, 69% of organizations were victims of spear phishing in 2021.

Identity Theft

Identity theft occurs when someone uses your personal information without your consent and then uses it to commit e-commerce fraud.

This might include but is not limited to stolen credit card information, address, bank account numbers, or insurance.

Once the thief gains access to personal information, he may commit fraud using the account holder’s name.

In 2023, 908,439 identity theft reports were filed in the US.

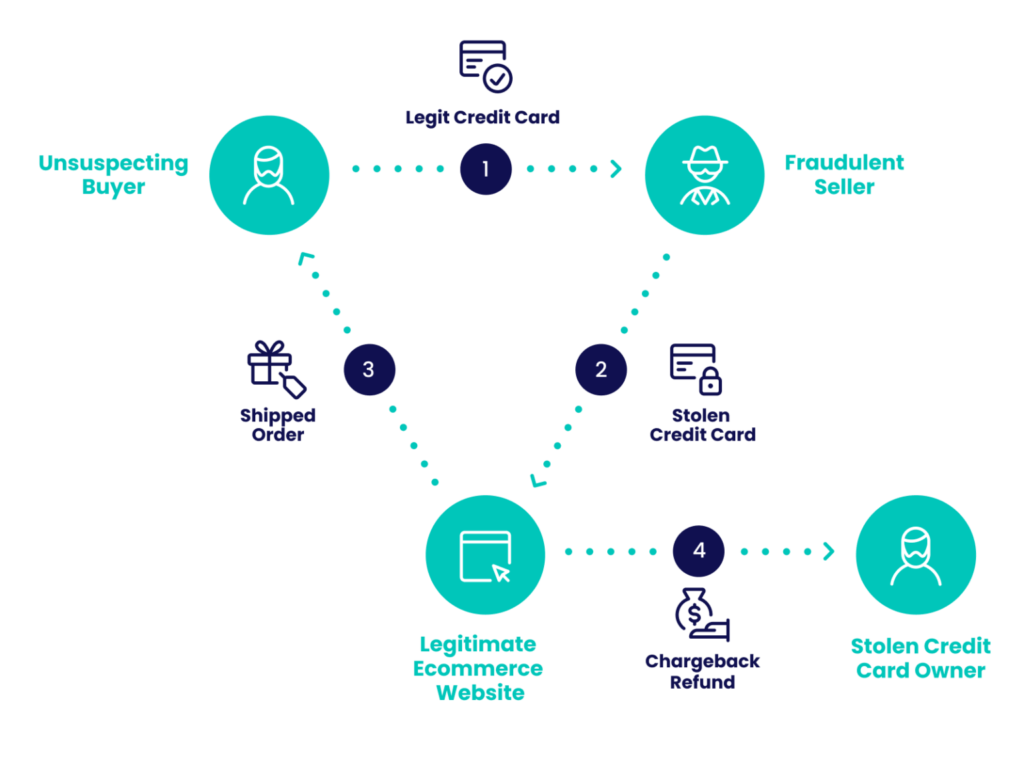

Triangulation Fraud

This fraud involves three people: a buyer, a scammer, and a legitimate merchant.

The scammer puts a fraudulent listing for a very low price on an eCommerce platform that allows third-party sellers.

Then, after the buyer confirms their purchase, this cybercriminal uses someone else’s stolen credentials to order a legitimate copy of the product and pockets the money you paid.

The seller faces chargebacks due to a fraudulent transaction and has to refund the money and pay extra.

The merchant may contact you and demand the product back, which may lead to fraud charges.

It is estimated that eCommerce merchants lose between $660 million and $1 billion monthly to triangulation fraud.

Wrap up

As discussed above, eCommerce fraud is a massive threat to the eCommerce industry.

Though eCommerce merchants invest heavily in fraud detection and prevention software, it is not enough to block cyber criminals.

The eCommerce fraud prevention efforts by online businesses have seen an improvement in recent years with the advancement of technology, but there are many cracks in the wall.

Unless another solution is found, the only way to prevent yourself from getting scammed is to be attentive and aware of who and where you share your personal information and question why it is needed.

Sources